Banks are often overburdened by the verification and data capture processes of paper-based documents. To add to the woes, stringent banking rules and regulations make the data extraction process extremely complex and time-consuming. Naturally, maintaining the quality and integrity of captured data while adhering to compliance requirements is a common challenge for bank employees.

The process not only drains resources but is also inaccurate and vulnerable to data breaches.

Employing intelligent document processing (IDP) software in banking workflows vastly improves employee productivity and the organization’s overall efficiency. AI-powered solutions, such as document AI for banks, reduce human intervention and offer the ability to scale economically.

If you’re still not convinced about the importance of integrating IDP into your legacy banking systems, this blog is for you.

Importance of document processing in banks

Banks and other financial institutions process a multitude of documents every single day. From bank statements and loan applications to P&L statements and identity verification documents, banks deal with a diverse range of critical paperwork. What led to the adoption of document AI for banks?

Challenges

Manually processing documents such as bank statements creates bottlenecks in digitizing document processing workflows in banking. The processes are time-consuming and prone to human errors. In addition, the reliance on manual labor to sustain the archaic processes often eats away at the institution’s profits.

Due to their nature of business, banks have to regularly deal with unstructured and semi-structured documents, which increases the processing time. Lastly, legacy systems are ill-equipped to handle new document formats and are resource-intensive.

Solutions

Intelligent document processing software helps banks extract critical information from structured, unstructured, and semi structured documents faster and with greater accuracy. It reduces human errors and improves the bottom line by automating data extraction workflows.

The extracted data is stored on secure and GDPR-compliant servers, which helps improve compliance with document AI in banks. Additionally, IDP software is highly flexible as it uses AI to understand and adapt to new document formats.

Understanding intelligent document processing

In a nutshell, intelligent document processing software is an amalgamation of traditional and contemporary technology. It uses conventional technology, like OCR (optical character recognition), along with cognitive technologies, like ML algorithms, natural language processing, deep learning, and computer vision.

The platform focuses on automating document identification and extraction processes, and banks can then categorize and store this information over the cloud or on dedicated servers.

Here’s a brief look at the automated document processing workflows of an advanced IDP.

1. Document Pre-processing

Data capture begins by collecting information from various sources. Document pre-processing techniques like binarization, deskewing, and denoising ensure data accuracy.

2. Document Classification

Intelligent document processing identifies and classifies document types such as bank statements, cash flow statements, P&L reports, address proofs, and more.

3. Data Extraction

Trained AI models employing deep learning, machine learning, and natural language processing extract relevant information from the source. Automated data extraction for banks focuses on key aspects like addresses, tax information, and monetary values.

4. Data Validation

Extracted data is validated against business rules and structured/unstructured data. Information verification and data matching with existing public records are examples of validation processes. At this stage, invalid data is flagged for correction.

5. Data Analysis

Banks and financial organizations leverage insights generated by IDP software to identify applicants’ spending patterns, income levels, and creditworthiness. Moreover, data analysis highlights error rates, and processing times, and normalizes the data for easy consumption.

6. Workflow Integration

Human-in-the-loop review enhances data accuracy and supports model learning. The final step involves exporting information to internal systems and integrating it with other business process workflows.

Key applications of intelligent document processing in banks

The most widely known use cases of IDP for banks are: to optimize their extensive loan application processing, enhance customer onboarding experiences, ensure compliance, and mitigate fraud risks.

1. Loan application processing

Loan application processing requires intensive information verification and data extraction validation in banking. To add to the woes, documents are received in batches and are of varying quality. The bank statement formats can differ bank-wise.

Banks are able to reduce processing time, costs, and overall turnaround time. The platform extracts the key information from bank statements and validates it against salary slips and expense bills.

The data captured from government identification is also verified using the public database.

Following the verification process, the loan application is automatically re-routed to the relevant personnel or bank managers for further approval. Another reason for the massive improvement in the productivity of the loan officer and the decrease in loan approval times is the system’s integration with third-party banking software.

2. Customer onboarding

IDP plays a vital role in streamlining customer onboarding and KYC processes. Previously, front-desk employees used to manually input the customer’s information into the system and separately upload the document’s scanned images for verification. This process paved the way for errors while being expensive.

IDP platforms streamline document processing in banks using a combination of OCR and AI. First, OCR is used to convert the scanned images into machine-readable digital documents. Then, AI is used to classify the document type and verify the details.

After data extraction, verification, and validation processes are completed, the platforms securely archive the documents for future use.

For instance, whenever a customer applies for an online checking account, they submit multiple documents, like a driving license, birth certificate, credit report, and IRS-furnished tax reports. The platform extracts data, like DOB, address, and name, from these documents and compares them against each other to ensure their validity.

3. Compliance checks

Banks face stringent compliance regulations that require thorough checks on customer information. Financial institutions are constantly monitored by statutory bodies, which are often unforgiving when they notice any lapses in the proper processes. Manual document processing and storage make banks more vulnerable to lawsuits and data breaches.

Intelligent document processing aids in performing these compliance checks efficiently. It automates the extraction of relevant data from documents like proof of address, tax forms, and financial statements, allowing banks to verify customer details against internal and external databases.

For example, customer data is extracted and used based on the country’s KYC guidelines. Similarly, the extracted data is stored on servers that are GDPR and SOC-2 compliant. Furthermore, IDP enhances the accuracy and speed of compliance checks for anti-money laundering.

4. Fraud detection

According to reports, government ID cards are the most commonly forged document type. However, manually checking their authenticity is too demanding for bank officials. IDP software’s ability to expand its fraud detection capabilities to even paper-based documents makes it an indispensable asset for the bank.

IDP platforms can directly push the data extracted from the documents into the bank’s fraud detection engines. The software’s integration with existing security measures makes the banks more efficient at identifying fraud and safeguards them from the risks associated with counterfeit applications.

It provides timely alerts and actionable insights to the fraud detection teams, enabling them to take proactive measures to prevent and investigate fraud.

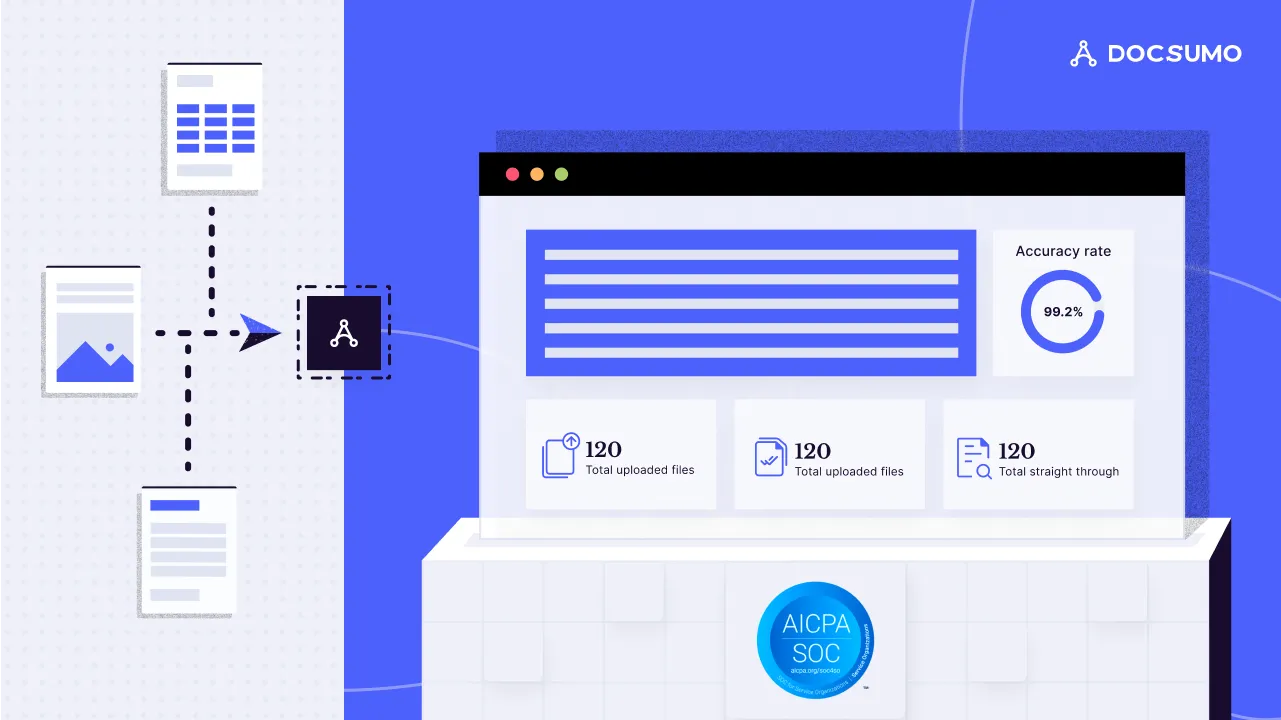

How does Docsumo enable intelligent document processing?

Docsumo, an intelligent document processing software, uses advanced machine learning algorithms and AI-trained APIs to enable intelligent document processing. Some of the notable Docsumo features are-

1. Data extraction with over 99% accuracy

Docusmo’s AI-enhanced document processing eliminates data entry errors and extracts data with an accuracy of over 99%. Unlike humans, Docsumo’s smart data extraction algorithm operates 24/7 while maintaining the same output quality and accuracy.

For that 1% error rate, Docsumo has an in-built failsafe that instantly flags unreadable data or any machine-made errors for manual review. Consequently, it frees your human resources to focus on other important business areas.

The intelligent document AI for banks is capable of extracting clean financial information even from non-standard income statements and balance sheets.

2. Seamless document classification

Docsumo scans through hundreds of ACORD forms, IRS tax forms, and bank statements and lines them up for extraction while processing insurance claims for the customer.

For commercial lending, the platform auto-identifies ID proofs, balance sheets, cash flow statements, credit card statements, credit scores, and employment and sends them to the relevant departments for verification.

Using the same pipeline, the documents are either sent for storage or archived, depending on their types. The organized storage of these documents helps bank officials retrieve them easily for reference in the future.

3. Smart data validation

Smart data validation safeguards against incorrect information and ensures reliable data for downstream applications. Docsumo employs intelligent algorithms and data validation techniques to ensure the accuracy and integrity of the extracted data.

It compares the extracted data against predefined rules, performs data matching, and validates it with structured and unstructured data sources. The result is: elimination of errors and discrepancies and the automatic highlighting of invalid or inconsistent data.

4. Smooth integration

Docsumo offers seamless integrations with a wide range of business systems and applications, facilitating smooth data transfer and reducing manual efforts. Through its APIs, Docsumo can integrate with customer relationship management (CRM) platforms, accounting software, and other third-party banking applications.

Integration capabilities allow for the seamless transfer of processed data, eliminating the need for manual consolidation and reducing the risk of data transfer errors.

In addition, native integration capabilities simplify data aggregation and enable large-scale data imports, reducing dependence on heavy IT infrastructure.

Ensuring security and compliance in document processing

Data privacy and compliance with regulatory requirements are paramount considerations in document processing, particularly in the banking sector. Docsumo offers robust features to safeguard sensitive information and meet regulatory standards.

1. Encryption

With Docsumo’s industry-standard SSL (Secure Sockets Layer) encryption protocols, rest assured that your data is secure at rest and in transit. Encryption ensures that documents and extracted data are protected from unauthorized access.

The login is protected from malicious crips, brute force attacks, and other common attack types and information is end-to-end encrypted. This means the data can only be accessed by the users using their passwords. And, these passwords are stored in encrypted hash keys and are even unavailable to the Docsumo Staff.

2. Access Controls

Granular access controls regulate user permissions and restrict access to sensitive documents and data. Administrators can define roles and access levels to ensure that only authorized individuals can view, edit, or export specific documents. Access controls minimize the risk of unauthorized access and help maintain data privacy and integrity.

3. Audit Trails

Comprehensive audit trail functionalities support compliance and accountability. The system maintains a detailed log of all user activities, including document uploads, modifications, extractions, and exports. Audit trails enable banks to track and monitor document processing activities, ensuring transparency and facilitating compliance audits.

Conclusion

To summarize, intelligent document processing for banks is no longer an afterthought, rather occupies the center stage of document processing.

The granular reports and insights offered by Docsumo help underwriters, bank officials, CTOs, and decision-makers to-

- Improve efficiency by 10x by integrating it with existing workflows and legacy banking systems using pre-trained APIs.

- Enhance accuracy, to more than 99%, of data extracted from bank statements and other financial tools.

- Reduce operational costs by 60-70% by reducing manual labor.

- Improve productivity by reducing processing time to 30 seconds.

.png)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)