Suggested

An in-depth Guide to Automated Invoice Scanning Software

Automated Invoice Processing, a key back-office task that can lead to a great deal of time & cost savings if automated correctly.

Accounts Payable automation comes with increased efficiency, accuracy and reduced cost. While adopting automation for accounts payable processes it is important to understand what goes behind the scenes, its benefits, and best practices to implement it smoothly.

To make it easier, we have compiled a list of to-do’s and simple hacks to help you with the effective implementation of AP automation in your business.

So, let's get right into it:-

Accounts Payable basically refers to an accounting term that is widely used to denote the outstanding amount due as debt by a company to its short-term creditors. Since companies often have to buy a large number of products and raw materials in the due course of business, it is not viable to make instant payments for all the purchases.

Due to this, companies prefer to buy such goods and materials on short-term credit, which needs to be paid back over a period of time.

However, companies often enter into such credit cycles with multiple vendors and supplies, which makes keeping track of the same on a day-to-day basis an impossible task. So, ledgers are maintained to keep track of the amount payable to such creditors.

The compilation of such amounts due to a number of creditors over a specified period of time constitutes what is called the ‘Accounts Payable’.

Now that we understand the core function of Accounts Payable let's explore how Accounts Payable Automation can significantly streamline and improve these critical business processes.

Traditionally, the Accounts Payable were maintained manually by the employees of the office. However, manual entry has often proved to be a tedious and time consuming task and was also highly prone to errors and delays.

With the advent of technology, fin-tech developers have come out with new methods to reduce the time taken on manual entries by 85% by automating the entire process through the aid of cutting-edge software and processing systems. It aims at minimizing human intervention and the reduction of the margin of error in the outputs derived.

Due to the fact that the process of automation uses advanced programming and software, they can consistently and efficiently process a large amount of data with a much greater accuracy than humans. It also has revolutionized the standards of business efficiency by providing several benefits over the traditional methods, which can lead to greater savings in terms of time and precious resources of the company.

To understand how Accounts Payable Automation works in practice, let's get into the specific workflow that drives these automated processes.

An AP workflow Process basically refers to a series of steps that are to be followed whenever an invoice is processed and the due payment is made. While companies have tried to standardize the workflows for the economical processing of the invoices, such a ‘one shoe fits all’ technique has not been very successful due to the different approvals that different invoices need based on their nature and type.

A study titled “AP Today: Bottlenecks, Benchmarks & Best Practices” by Stampli and Treasury Webinars found that 72% of the companies surveyed had special approvals depending on the invoice criteria. However, there still are certain basic steps that can be broadly standardized as being essential parts of the Accounts Payable Automation Process.

So, Accounts Payable Automation Workflows can accordingly be divided into three parts, namely -

Invoices can be received electronically or automatically converted from paper to a digital format, which the software can process. Electronic invoices can be received in various formats such as PDFs, B2B/EDI connections or any other similar format and then converted to the system-accepted format using Artificial Intelligence or OCR.

Once the data has been captured and converted to the system-accepted format, the invoices are then matched either to the purchase order or goods receipts. However, most modern AP software also enables three-way matching of the invoices. Sometimes, the users may also customize the software to automatically reroute specific invoices to the relevant team or individual to review and approve the invoice. Once approved, the invoices are then sent to the ERP or the relevant accounting system for the payment to be made.

Once the payment is made, all the invoices are then securely archived and stored with the audit trails for the purpose of financial audits. The storing of the data systematically in a digital archive helps enable easy access to the relevant invoices as and when required. Since the storage is usually cloud-based, these invoices can even be accessed remotely.

While these are the basic steps of the automation process, the workflows of each and every business vary in accordance with the mode and type of business. While smaller businesses can continue managing their Accounts Payable manually, larger businesses often have much more complex ledgers and accounts to be settled. Workflows play a large role in ensuring that the tasks are done in the most efficient and economical manner.

However, it is often seen that in Accounts Payable tasks carried out by humans, there are high chances of workflows falling into disregard, but in cases of automated AP processes, workflows are more likely to be followed, and efficiency is likely to be maintained.

Further, newer softwares allows the users a high degree of flexibility in enabling the software to adapt to the existing workflows of their business to provide the best outputs.

Now that we understand the typical workflow of Accounts Payable Automation let's explore the key benefits that businesses can realize by implementing these automated solutions.

There are several benefits of shifting or automating your accounts payable processes, such as -

With the rise of labor expenses, carrying out time-consuming processes manually has become very expensive. Thus, the ability of the automation processes to carry out the tasks with efficiency has become increasingly sought after since unlike humans, software can carry out the processes without being subject to fatigue of any form.

According to Aberdeen Group, AP automation can save up to 5 days payable outstanding (DPO) on average. This could lead to immense savings in terms of time and money by eliminating human intervention and reducing the manual stages of invoice processing to the very minimum.

Further, automation processes streamline the workflows to provide more efficient outputs and enable its integration with the existing financial systems to facilitate seamless exchange of data. This could boost overall productivity and lead to immense savings in terms of time and money by eliminating human intervention and reducing the manual stages of invoice processing to the very minimum.

While manual tasks are often prone to error due to a variety of reasons, the same is not true for automated tasks. The use of advanced software and programming enables the outputs to be accurate and free from errors. This goes a long way in reducing risks of payment errors such as duplicate and fraudulent payments, which could cause serious loss to any business.

The improved accuracy also ensures that the quality of the output is maintained and unnecessary waste of time and resources due to errors are reduced to a great extent. Modern AP software also has additional measures such as timely payments, data verification, error flagging, etc., which play a major role in ensuring that the entire process remains on schedule and there are no extra costs to be incurred.

While manual tasks can be hard to keep track of, automated processes provide systematic track records to enable users to be easily able to keep track of the invoices received and the payments made against them. This ensures that the entire process is transparent and free from errors or fraudulent activities.

It also provides for added security measures such as invoice matching, false or duplicate billing alerts, malware detection, vendor verification and a precise auditing system, which ensures that the entire process remains transparent and accountable. It also provides electronic audit trails to ensure that any audit error can be quickly detected, tracked and remedied.

Automation softwares also allows improved productivity by streamlining the workflows and ensuring that the workflows are followed properly. It also allows users to customize the workflows, reroute the invoices, mandate approvals, etc., to suit the needs of the given business to ensure that the level of productivity is maintained.

Since the records of the AP database are stored digitally on the cloud storage, employees can access and work on the platform from anywhere. It also allows employees to collaborate, dispute, discuss, clarify or explain any discrepancy in the system remotely.

To fully realize the potential of Accounts Payable Automation, it's essential to follow best practices that ensure efficiency, accuracy, and a smooth transition to automated processes.

While shifting to Accounts Payable Automation definitely has several benefits, such benefits can seldom be realized if it is not followed by certain practices that can help realize the true potential of the automation process. So, the best practices to implement are:-

The transition to the automation process can inevitably lead to some amount of concern and resistance among your staff. So, it is important to involve your staff in the transition process from day one to make them understand that the process is to aid them and not to usurp their jobs. Any attempt to forcefully implement the change is likely to make the entire process futile by negating any positive effects that are likely to be derived from it.

Ensure that you take note of the pain points that may emerge among your employees during the process of transition and take steps to rectify the same immediately. Documenting their feedback and issues will also help you understand the key areas where automation is to be implemented on a priority basis. Once the automation process is in place, ensure that you take regular feedback from the employees and adapt your system accordingly to derive maximum benefits.

While automation processes require minimal human inputs, they still require some amount of human supervision that is necessary to ensure the smooth functioning of the system. If the employees are untrained and unaware of how the entire process works, it would lead to serious damage due to mistakes that would have been avoidable with proper training.

Remember to keep track of the real time data received from the automation software to improve the skills of your employees accordingly to avail maximum benefits of the automation process. Further, it is also important to ensure regular training sessions to make sure that your employees can deal with any system updates in the AP Automation Process.

Workflows are essential for the efficient and economical output of results. While Automation Processes can carry out the processes rapidly, it is the proper designation of workflows that ensures that quality and efficiency are maintained. It can only happen when there is a clear workflow for the automation process as well as every member of the team to follow.

However, the workflows can vary depending on the needs of each business, so it is essential to analyze the required workflow and implement it accordingly to reduce the chances of errors and ambiguity. It also helps improve the overall accountability of the team as well as the automation process.

For the Accounts Payable Automation to be effective, it needs to be integrated with the existing systems. Such integration can include several components like the financial systems, customer service, vendor access points, etc. which need to be digitized to enable a seamless exchange of relevant data to maintain the optimum level of efficiency in the system. Similarly, vendor access portals can be set up to enable vendors to check the status of their invoices and to address common queries.

These are a few of the Accounts Payable Automation best practices to implement to ensure that you derive the maximum benefits out of your automation process.

Please visit our blog for a more detailed analysis of the best practices to implement in AP Automation.

By following best practices, businesses can maximize the return on their investment in Accounts Payable Automation. Let's explore the key metrics and factors that contribute to a strong ROI.

When considering the transition to Accounts Payable Automation, it is important to calculate the Return on Investment (ROI). However, calculating the Return on Investment can be a little tricky in terms of AP Automation since the benefits can be divided into two parts, namely financial and non-financial returns.

In the case of financial returns, the primary factors to consider are:–

Similarly, in the case of non-financial returns, the factors to be considered are -

To help businesses make informed decisions, let's explore some of the top Accounts Payable Automation software solutions currently available in the market.

As the popularity of AP Automation increases rapidly, there has been an increase in the number of Automation Software. So, choosing the right software in the face of so many alternatives can be a mammoth task and we’re here to help you with the task. While you

can visit our blog for a more detailed comparison, we’ve prepared a curated list of the top 5 AP Automation Software to choose from. They are as follows:-

Docsumo is an intelligent document processing software that aims to help users extract data from any document with ease using pre-trained Invoice Capture API that can capture the data accurately from documents of varied formats and convert it into digital data in a format that is accepted by the system. It offers various features and an interactive user interface that enables users to use the software efficiently with minimal training.

Docsumo offers 3 pricing packages:-

Stampli AP software is best known for its ability to process invoices in real-time to ensure the immediate and efficient processing of invoices. In addition, it also has one of the most user-friendly interfaces among its competitors, which makes the entire process a hassle-free experience.

Stampli also features a centralized communication hub which helps users and entities to cooperate and get instant resolution of queries. Enterprises also have the added option to enact and enforce various internal controls to ensure better management and supervision of their resources.

Contact Stampli for Pricing.

Tipalti is a cloud-based integrated automation software that provides effective tools like end-to-end payment tools, invoice automation, automated approval and self-service supplier automation to facilitate efficient management of the AP processes.

Additionally, Tipalti also empowers global transactions by allowing users to carry out mass vendor transactions in multiple different currencies.

Contact Tipalti for Pricing.

Nanonets is a powerful Accounts Payable Automation software that enables users to transform unstructured receipts, POs and invoices into a well-structured format.

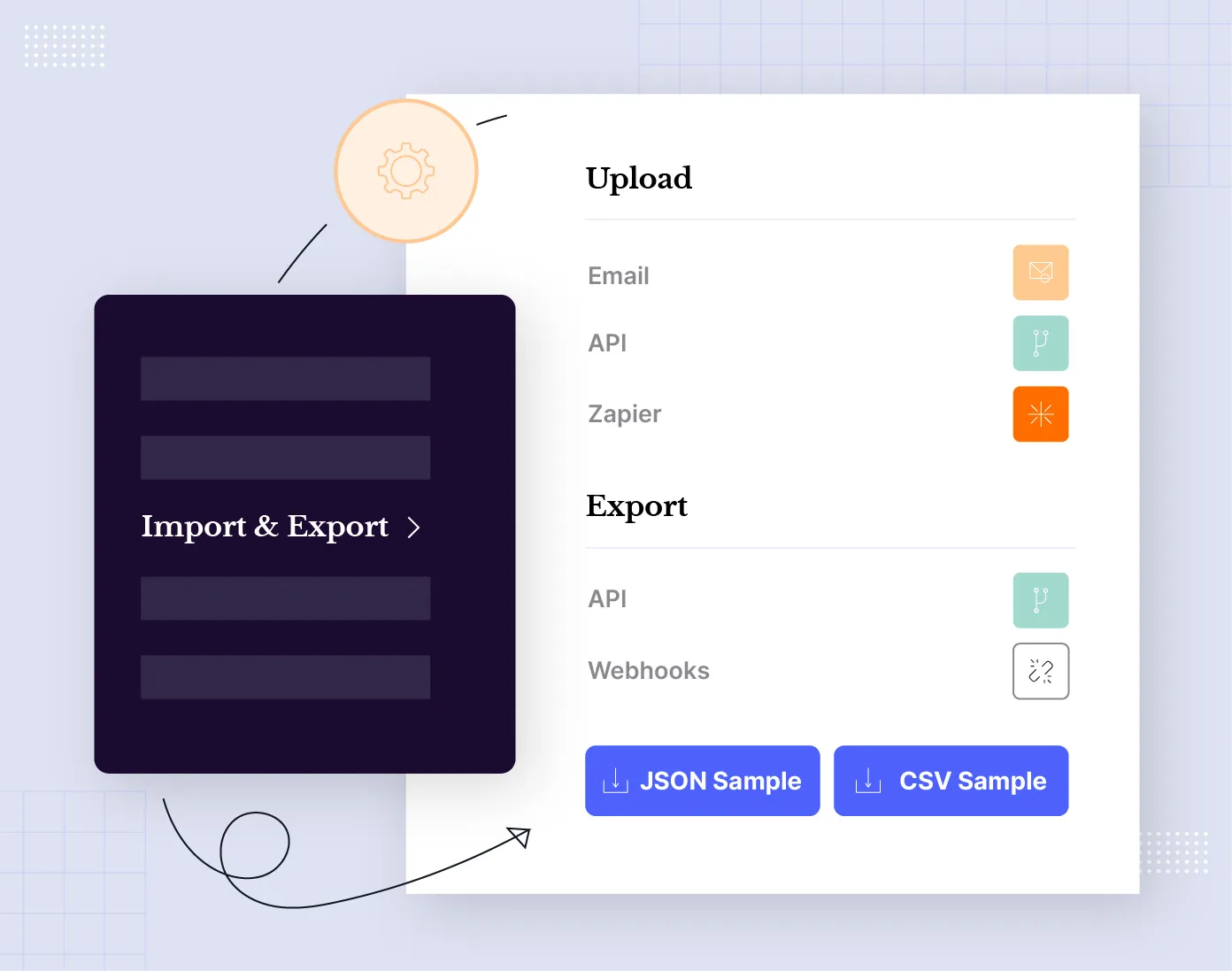

Users can upload the documents in a variety of formats, such as digital PDFs, Scanned Invoices, etc. and through a variety of ways such as RPA, Drive, Dropbox etc. The processed documents can also be seamlessly integrated with cloud storage services as well as ERPs like Salesforce, Yardi, Netsuite, etc.

ABBY Flexicapture is an efficient document processing software designed to be able to capture and convert complex documents of any layout into digital data. It also offers interesting features such as automatic document classification, and paperless document capture and consists of a highly scalable architecture that enterprises can utilize to realign their core business operations while reducing costs and boosting their overall efficiency.

$29.99 per month for up to 500 pages with a proportional increase in price in accordance with the amount of pages processed.

To illustrate the power of Accounts Payable Automation, let's examine a real-world example: how Docsumo can help businesses streamline their Accounts Payable processes.

Docsumo automates accounts payable in 4 easy steps:-

Upload invoices directly to Docsumo’s pre-trained API specially built for invoice data capture directly from your email inboxes.

The API supports all the popular formats for invoices, including scanned photos of paper invoices, and can adapt to any changes in formats/templates/layouts of invoices.

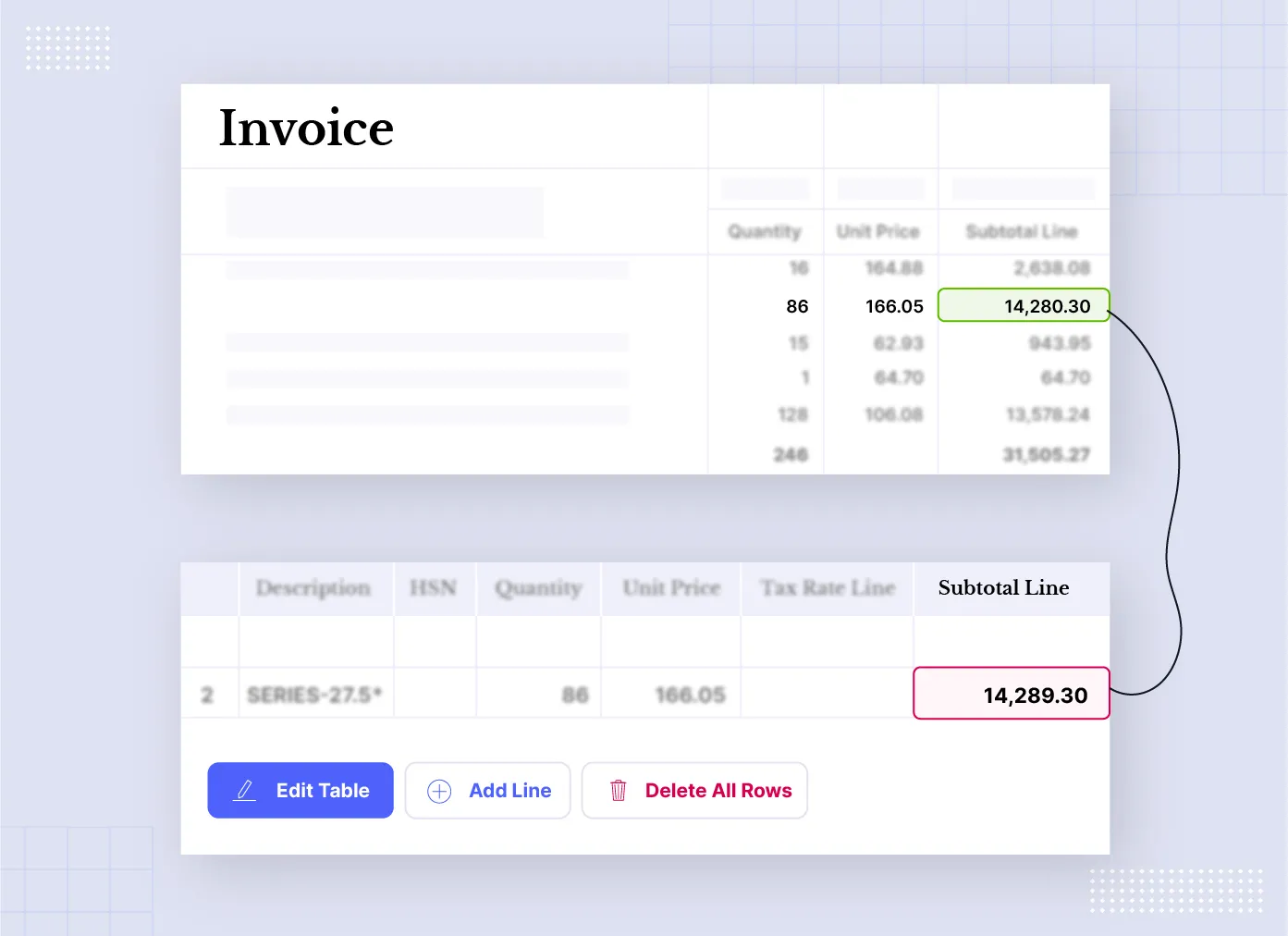

The system scans the document and automatically extracts valuable information like the payee's name, the amount due, account numbers, invoice numbers, and due dates. Docsumo measures up to 99% data capture accuracy.

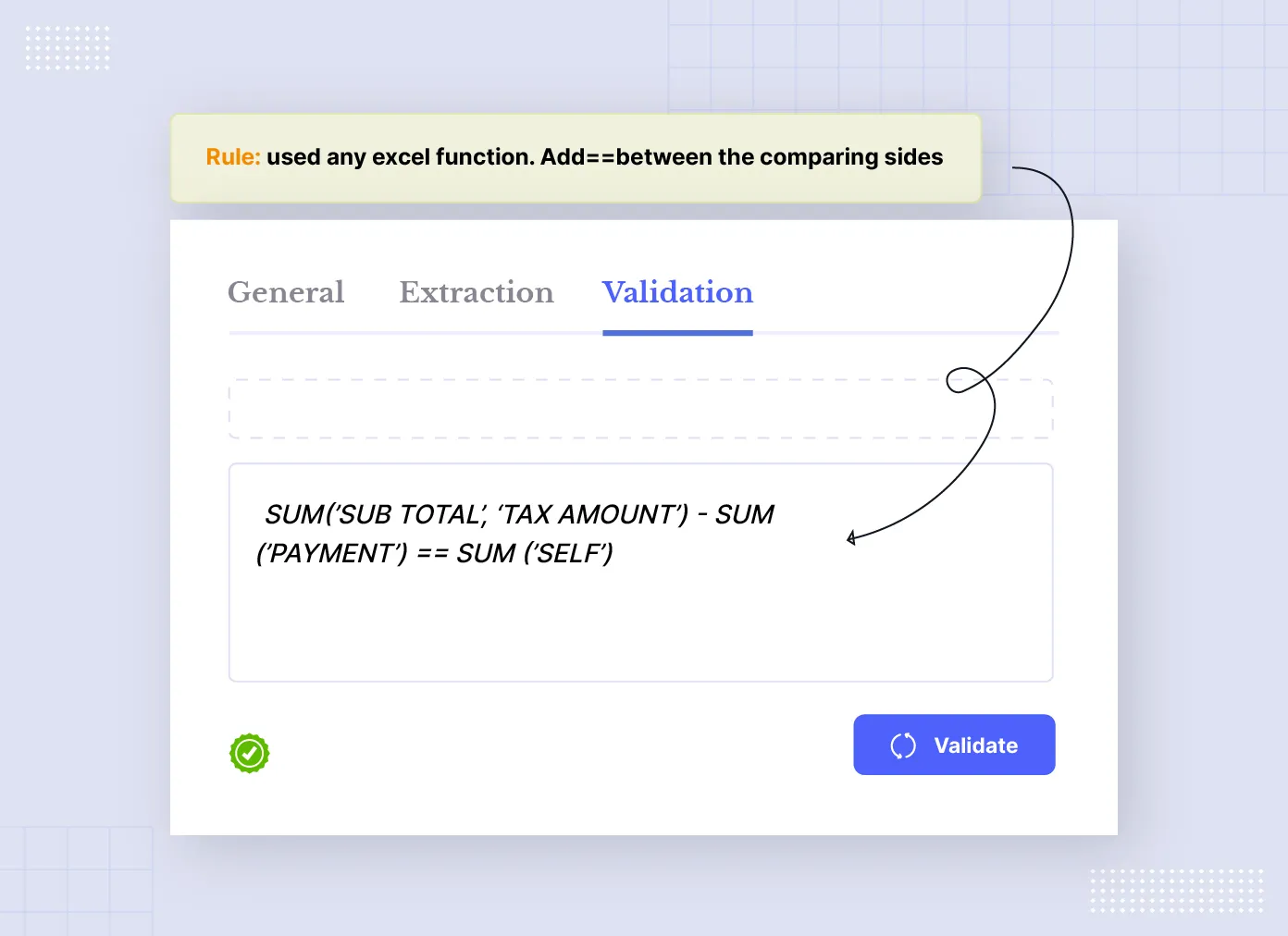

Captured data is validated for accuracy before improved accuracy. Reviews are held for manual review.

Docsumo can easily be integrated with any CRM or ERP software. Post-processed data is pushed into a database for analytics and decision-making.

To summarize, accounts payable automation offers increased efficiency, cost savings, and data accessibility. Reduction in manual entry errors and improved control over finances empower brands to shift their focus toward critical value-added business strategies.

In a nutshell, switching to accounts payable automation improves your business' profitability along with saving time on the cost of invoice processing.

To further understand the impact of Docsumo's AP Automation solution, let's examine a real-world case study that demonstrates the tangible benefits achieved by a company that implemented its platform.

While we’ve already covered the key features that make Docsumo the best account payable software, let’s look at a case study to prove our point.

Australian managed service provider Valtatech automates invoice processing using Docsumo, bringing down the processing time from a few hours to less than 30 seconds with 99% accuracy.

Their team used to struggle to extract unstructured data from 20,000+ invoices manually.

They implemented Docsumo’s AP automation software to extract accurate data from documents with varying fonts, image quality, and resolution. The NLP-based classification framework was trained to categorize key-value pairs such as invoice number, date, and vendor details.

The result of implementing accounts payable automation was:-

.webp)

If you’re looking to automate your accounts payable, try out a 14-day free trial to Docsumo’s smart invoice capture API, or talk to our automation experts.

AP automation makes the invoice approval process seamless by identifying the correct approvers, sending reminders automatically and carrying out the approval process according to the designated workflow, which streamlines the entire process and removes any unnecessary human involvement.

AP automation can help resolve invoice-related communication issues by creating an accurate, real-time record of any comments, questions and inputs made by the concerned person relating to a specific invoice or relevant document. This also means that documents and communication records are stored in a transparent manner and can be easily accessed by all authorized personnel.

AP automation provides a comprehensive set of internal controls that can be introduced to the financial processes to enhance its security and reduce the chances of fraud. Automation software also comes with features like approval limits, false billing alerts, requirement of special permissions, audit trails, etc which enhance the transparency and accountability in all transactions.

With that we wrap up our blog about the basics of Accounts Payable Automation with the hope that it has enabled you to understand the concept of AP Automation better and will help you in choosing the right AP Automation Process for your business.